how is a federal loan different from a private loan for an education?

Federal loans and private loans are frequently the two primary loan options available to families and students when it comes to funding higher education. Tuition, fees, and living expenses can be partially covered by both alternatives, but there are substantial differences between them in terms of eligibility, periods, interest rates, and repayment plans. Making an informed choice about how to pay for your education requires knowing the main distinctions between these two loan kinds.

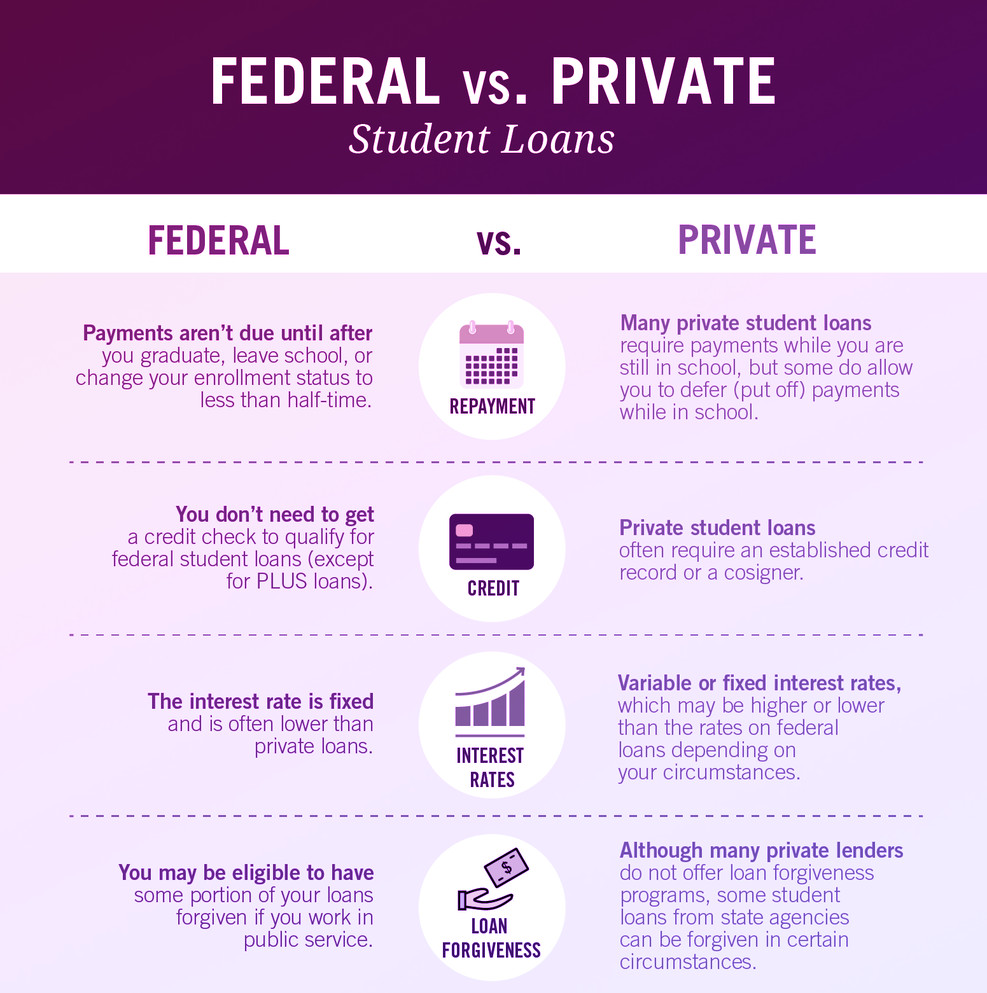

Eligibility is one of the most significant differences between government and private loans. Students who fulfill certain eligibility requirements, such as being a citizen or permanent resident of the United States and enrolling in an approved institution or university, are eligible to apply for federal student loans, which are financed by the American government. These loans are more accessible to a larger group of students, particularly those with little or no credit history, because they don’t require a cosigner or a credit check. On the other hand, eligibility for private loans is usually determined by the borrower’s creditworthiness and is provided by private lenders like banks, credit unions, or online lenders. Some students may find it more difficult to get private loans since private lenders may need a cosigner, especially for those with short or bad credit histories.

Another important distinction between federal and private loans is interest rates. The government-set interest rates associated with federal student loans are fixed, meaning they don’t change throughout the course of the loan. In addition to offering better terms, like the ability to postpone payments while enrolled in school, these rates are typically lower than those of private loans. Contrarily, variable interest rates on private loans are frequently subject to change over time, which could result in higher rates and greater uncertainty over the final amount that borrowers would pay. Although the rates are typically higher than those of federal loans, some private lenders also provide fixed-rate choices.

Federal and private loans also differ greatly in terms of repayment alternatives and terms. Income-Driven Repayment (IDR) plans, which modify monthly payments according to the borrower’s income and family size, are one of the flexible repayment options offered by federal loans. Federal loans also include the possibility of loan forgiveness under specific circumstances, such as through Public Service Loan Forgiveness (PSLF), as well as deferment and forbearance options in the event that borrowers have financial difficulties. Private loans, on the other hand, usually have stricter repayment terms and fewer possibilities for forbearance or postponement. Private lenders might not provide any kind of loan forgiveness and are typically less accommodating when it comes to changing repayment terms.

The degree of borrower protection is another significant distinction between federal and private loans. Numerous borrower protections are included with federal loans, such as access to federal loan forgiveness programs, income-driven repayment alternatives, and set interest rates. For borrowers who could have trouble making their loan payments, these safeguards offer a safety net. Private loans, on the other hand, provide fewer safeguards. With private loans, borrowers must abide by the conditions specified by the lender, which may include greater interest rates, less advantageous terms for repayment, and fewer possibilities for forbearance or deferment. In times of financial difficulty, private lenders could also have stricter criteria for determining who is eligible for repayment relief or changes.

In conclusion, federal loans often offer better terms, cheaper interest rates, and greater repayment flexibility, even if both types of loans can assist students in covering the cost of their education. For most students, federal loans are the preferable choice because they are easier to qualify for and offer significant borrower safeguards. However, students with solid credit histories who can obtain a lower interest rate or those who require additional funds beyond federal loan limits may need to take out private loans. Before choosing a loan type, families and students should carefully weigh their alternatives, considering interest rates, repayment schedules, and possible borrower protections.